In this unprecedented time of the coronavirus, it seems like we are bombarded with bad news everyday. Rising cases, loss of lives, high attrition rate, companies grappling with the unique situation, children adjusting to online classes and the inevitable slowdown of the economy has put life, as we know it, on hold and forced us to re-evaluate our habits and practices. Everyone is coping to the best of their abilities and the pandemic has proven that nothing can break the indomitable human spirit. Contrary to general belief, real estate as a vertical has been less affected than others because housing is a basic need and this pandemic has made people realize the importance of owning a home. The age old saying- “Apna Ghar to Apna hi hota hai” has made a comeback with people giving more value to owning a home in a township or society instead of renting one. Real estate industry is one the highest contributors to the economic growth of the country and also employs the highest number of labourers. In order to kickstart the economy, the Govt. would first have to bring in changes which positively impact stakeholders of the real estate industry, and the announcement of reduction in home loan interest rate is the very first step in this regard.

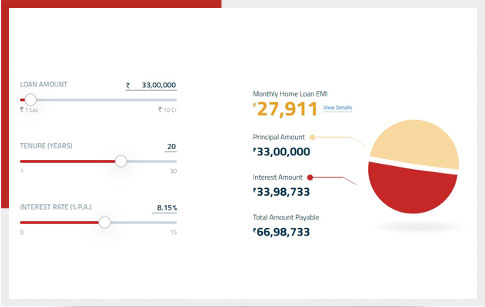

The RBI took a positive step in this direction by reducing its repo rate to 4%. In response, Housing Development Finance Corporation (HDFC), India’s largest private sector mortgage financier has also provided much needed relief to all its existing retail home loan and non-home loan customers by reducing its RPLR (retail prime lending rate) by 20 basis points to 16.2% following which its new rates will now range between 7.5-8.5%. Let’s take an example to understand the impact of this change on your wallet a little better. If the loan amount is ₹33 lacs, previous EMI would have been ₹27,911 per month which has now reduced to ₹25,486 per month. This would lead to huge savings for the customer. The lending rate cut will also positively impact home buyers affordability, which means that because of reduction in home loan interest rate your eligibility for the home loan has also increased. Let us understand with an example: Suppose your loan eligibility is 50% of your monthly take home salary, so for an individual earning Rs.75000, the loan amount worth Rs.44,33,675 would increase to Rs. 48,55,623 which broadens the scope to opt for bigger size flats or home in a high quality township that provides world class facilities for the entire family like swimming pool, club house, reading lounge, AC gym etc. The rate reduction has increased the purchasing power of the customers by about 15%, so for an EMI of Rs. 27911 your home loan would be worth Rs. 33 lacs but now for an EMI of Rs. 27957 you can get a loan of Rs. 36.2 lacs. This piece of good news in this difficult time is bound to bring a smile on every customer’s face.

(Source: HDFC.com)

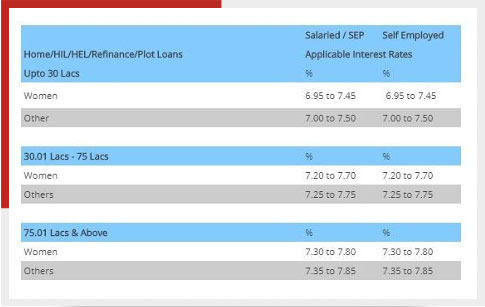

Keki Mistry, Vice Chairman of HDFC stated to Economic Times that the rate cut reflects its lower cost of funds which have been passed on to the existing home loan and non-home customers and easy liquidity has also made funds cheaper for future home buyers and increased their loan affordability. HDFC charges between 7.5%-8.5% interest on home loans. In lieu of the changes, Home Loans up to Rs 30 lacs will be charged lower rates while home loans above Rs 50 lacs will be charged at the upper-end of the band. HDFC charges a processing fee of up to 0.05% of loan amount subject to a maximum amount of Rs 3,000 plus GST.

Infographic shown below throws light on the recent changes:

Source: times now news

So, in conclusion home buyers can now rest assured with respect to the profitability and security of their real estate investments. The Govt. is taking adequate measures to ensure all industries including real estate is back on track at the earliest. Home buyers can easily buy their dream home now as buying rates have been reduced to attract them and lending rates on home loans have also been reduced by banks to convenience existing customers and captivate new ones. The cut in lending rates also increases the purchasing power of the home buyer; hence they’ll be able to afford a bigger and better property with the same amount of investment. By investing in real estate now, investors would be directly helping the economy and industry get back on track which is a win win for everyone involved.

Ashiana, Ashiana Housing build homes. Homes surrounded by vast green spaces and fresh breeze. Homes cocooned in secured gated complexes. Homes where futures are forged and there are opportunities to grow. And Homes in environments brimming with healthy activity, trust and respect. At heart, we build communities with care.

Other posts by Ashiana

Join 1000+ of fellow readers. Get expert real estate knowledge straight to your inbox absolutely free. Just enter your email address below.