Non-resident Indians have played a significant role in the Indian real estate market. They generally buy properties in India for investment purposes or out of pure emotional connection to the country and if they plan to settle back, once they retire.

According to Knight Frank’s Active Capital report Indian real estate has seen a massive surge from domestic as well as NRIs. According to the report foreign investments in Indian realty rocketed from USD 3.2 bn during 2011-13 to USD 7.6 bn during 2014-16 recording a staggering growth of 137%.

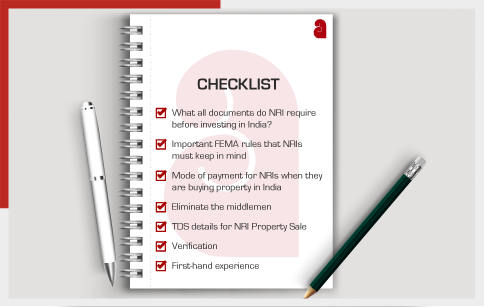

In addition to that, the procedure for NRI to buy property in India has become a hassle-free job. However, a few points NRIs should know before making a real estate investment are as follows-

What all documents do NRI require before investing in India?

For all those who are planning to invest can rejoice as there are not a lot of documents required, all they need is a passport, address proof, a permanent account number (PAN card) and a recent photograph while looking for a property to invest in.

Important FEMA rules that NRIs must keep in mind

The Reserve Bank Of India has made buying property in India a lot easier for all the NRIs with their Foreign Exchange Management Act (FEMA).

“An NRI or person of Indian origin (PIO), as defined under FEMA, are eligible to acquire by way of purchase, any immovable property in India other than agricultural land/plantation property or a farmhouse. This is under general permission that has been given by the government of India. However, no person who is a citizen of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal or Bhutan, is allowed to acquire or transfer immovable property in India, other than lease, not exceeding five years, without prior permission from the Reserve Bank,” says Amarjit Bakshi, managing director, Central Park.

Mode of payment for NRIs when they are buying property in India

Any NRI who doesn’t have funds ready with them, they can still apply for a home loan. RBI have now started granting permission to banks and housing finance institution that are currently registered with the National Housing bank which will then provide home loans for NRIs to buy residential property in India. One thing that NRIs needs to give paramount importance is that all transactions have to be made in Indian currency only.

However, there is a catch, the loan cannot be credited directly to the bank account of an NRI. It can only be disbursed to either the seller’s or the developer’s bank account directly. The loan, however, can be repaid using funds in an NRI’s NRO(Non-Residential Ordinary) /NRE(Non-Resident External) account or FCNR (Fixed Deposit Foreign Currency account) deposits.

Eliminate the middlemen

What an NRI needs to do is eliminate the middlemen to ensure that the price of the property and commitment is pure and original. Whereas, it is wise to directly purchase the property from a trusted and reputed builder who has built an empire over the years.

TDS details for NRI Property Sale

When it comes to tax benefits, they are pretty similar to any resident of India. Any NRI is entitled to all the same tax benefits as a resident Indian. In addition to that, NRIs have to pay a withholding TDS at the rate of 1% if they decide on buying a property worth more than Rs 50 lakh.

They will be exempted from wealth tax if the property is vacant and declared as ‘self-occupied’. Else they will have to rent it out for at least 300 days a year to avoid paying wealth tax. This rule is only for the first property only. For subsequent vacant properties, they will have to pay the tax at the rate of 1% the value (net of outstanding loans) more than Rs 30 lakh.

Verification

NRIs should do a mandatory backcheck of the builder by inspecting the social media accounts of the real estate company and other online forums.

First-hand experience

One needs to look for the first-hand experience by connecting with existing customers online to get an exact idea of how satisfied they are with their investment.

POA for buying property

As they don’t reside here so, therefore, there can be occasions the said person can’t be physically present in India to buy the property, but to the rescue, POA (Power of Attorney) is there. What this means is that an NRI can choose someone who is close to them like any relative, friend or even a colleague and all them(legally) to complete the transaction on your behalf.

Ashiana, Ashiana Housing build homes. Homes surrounded by vast green spaces and fresh breeze. Homes cocooned in secured gated complexes. Homes where futures are forged and there are opportunities to grow. And Homes in environments brimming with healthy activity, trust and respect. At heart, we build communities with care.

Other posts by Ashiana

Join 1000+ of fellow readers. Get expert real estate knowledge straight to your inbox absolutely free. Just enter your email address below.