Budget 2026: Key Takeaways for Homebuyers in India

February 27, 2026 Real Estate Investment

As the Union Budget for the upcoming Financial Year was presented, Budget 2026 delivered several signals worth attention for homebuyers in India and the broader real estate market. Although it did not introduce headline tax breaks for residential property purchases, this year’s fiscal blueprint emphasizes strategic infrastructure expansion, a development that can shape where and how people buy homes in...

Read More

3 BHK Flats in Gurgaon: The Perfect Choice for Growing Families

February 26, 2026 Real Estate Investment

Over the last decade, Gurgaon has transformed from a satellite town into one of India’s most aspirational urban centres. Driven by rapid infrastructure development, strong employment opportunities, and evolving lifestyle expectations, the city has become a preferred destination for families planning long-term settlement. Within this landscape, 3 BHK flats in Gurgaon stand out as a practical and future-ready housing option,...

Read More

Real Estate Pune Sees Rising Demand Backed by Infrastructure Expansion

February 25, 2026 Real Estate Premium Homes

Over the past decade, real estate Pune has steadily transformed into one of India’s most structurally strong urban property markets. Unlike cities driven purely by cyclical sentiment, Pune’s growth story is increasingly anchored in infrastructure expansion.

Read More

The Rise of Tier 2 and Tier 3 Cities: A New Growth Engine for Real Estate Investor

February 25, 2026 Real Estate Investment

India’s real estate landscape is evolving rapidly. While metro cities continue to attract attention, the real momentum is now shifting towards Tier 2 and Tier 3 cities. Backed by infrastructure growth, economic decentralisation, and supportive policy measures, these emerging markets are unlocking powerful opportunities for Real Estate Investors.

Read More

Top 5 Indian Cities for Real Estate Investment in 2026

February 24, 2026 Real Estate Premium Homes Investment

Real estate investment in India is entering a decisive phase in 2026. With infrastructure expansion, rising urban migration, and steady economic growth, investors are once again evaluating where to deploy capital for the best long-term returns.

Read More

Dwarka Expressway Growth Story: A Transformational Opportunity for Homebuyers

February 24, 2026 Real Estate Investment

The Dwarka Expressway has quietly evolved from a planned infrastructure corridor into one of the most influential growth drivers in the NCR property market. Also known as NH-248BB, this 27-kilometre expressway is reshaping how people move between Delhi and Gurgaon, while simultaneously unlocking new residential and investment opportunities.

Read More

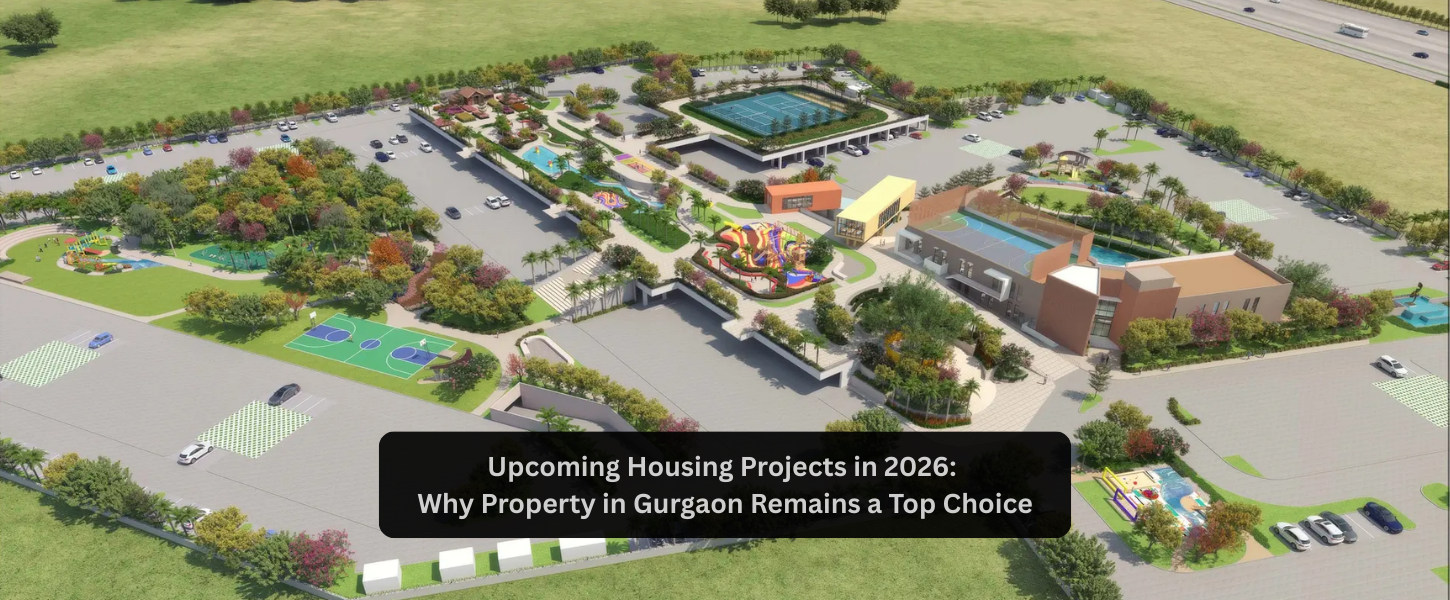

Upcoming Housing Projects in 2026: Why Property in Gurgaon Remains a Top Choice

February 23, 2026 Real Estate Premium Homes

The conversation around Property in Gurgaon is gaining momentum in 2026. With new infrastructure corridors nearing completion and developers preparing fresh launches, the city continues to attract both end-users and investors. From modern high-rise apartments to thoughtfully designed family-focused communities, Gurgaon’s residential landscape is evolving rapidly.

Read More

Making Holi Celebration Kid Friendly with Smart Safety Tips

February 23, 2026 Real Estate Kid Centric Homes

Holi is one of the most joyful festivals in India. Bright colours, cheerful music, festive sweets, and community bonding make it a celebration children eagerly wait for all year. However, when kids are involved, safety tips become even more important. While the Festival of Colors India is famous for being full of laughter and excitement, parents need to take a...

Read More

Eco-Friendly Holi Celebration Ideas that Strengthen Community Living

February 21, 2026 Real Estate Investment

Holi Celebrations are more than just colours, music, and festive sweets. They represent togetherness, renewal, and the joy of shared experiences. Across neighbourhoods in the Holi Festival India is known for, families gather to celebrate the arrival of spring and the victory of good over evil.

Read More

Top Reasons to Invest in a Home in Gurgaon in 2026

February 17, 2026 Real Estate Investment

Buying a home in Gurgaon in 2026 is not just about owning property , it is about securing a future in one of India’s fastest-evolving urban landscapes. With enhanced connectivity, strong infrastructure, rising demand, and improving rental markets, Gurgaon stands out as a highly desirable real estate destination.

Read More

How Budget 2026 Reforms Could Shape Real Estate Investment Opportunities for NRIs

February 16, 2026 Real Estate Investment

The Budget 2026, introduced by India in February 2026, marks a notable pivot to enhance the investment landscape for Non-Resident Indians (NRIs). With an emphasis on simplifying tax compliance, easing property transactions, and nurturing investor confidence, these reforms are poised to transform real estate investment patterns for NRIs and global Indian investors.

Read More

India’s Infrastructure Revolution 2026 and Its Impact on Real Estate Valuation

February 14, 2026 Real Estate Investment