For NRIs who want to have some roots back home, the Indian property market has always been a very attractive proposition. Reasons for NRI investments can range from upgrading the family home to offering a better lifestyle to their parents or having a comfortable home to live in after retirement when they relocate to India.

#TipsOnBricks | Top-Up Home Loans & Loan Against Property

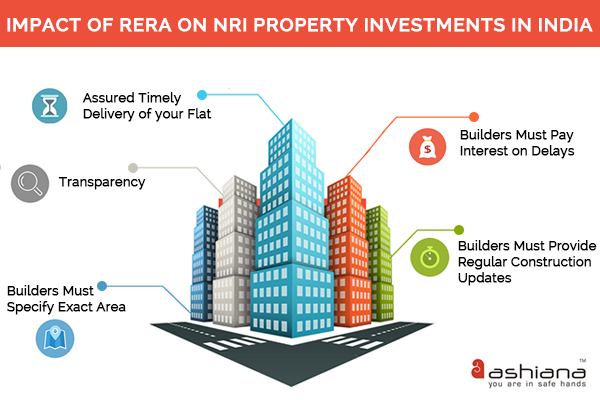

The most common concerns of NRIs investing in India’s property market have been lack of transparency and information, no standardized process for due diligence, untimely delivery of projects with little or no legal recourse for home buyers. For NRIs (especially), the futility of following up with errant builders was a major stumbling block to investing in their home country.

But with the introduction of RERA, NRIs can look forward to confidently investing in India in 2017 and beyond.

5 Things NRIs Can Expect Post-RERA When Buying Property in India

In a post-RERA scenario, you can finally breathe free and invest confidently in India as an NRI. Unscrupulous developers will no longer be able to take you for a ride. Whether you’re a looking for a great senior living property or a promising investment option near Delhi NCR, here are 6 ways in which RERA will protect your interests and help you to invest confidently in your dream NRI property.

In the pre-RERA days, builders invariably failed to deliver their projects on time because they would either divert their funds to another project or because they had sold the project without obtaining the necessary statutory permissions. Such delays invariably led to price escalations, and in the absence of a strong regulatory body like RERA, buyers like you were at the losing end.

In the post-RERA scenario, builders will not be able to get away like this. Because RERA makes it mandatory for a builder to keep 70% of the buyer’s payment in a separate bank account. The money from this account cannot be diverted to any other project; it must be used only towards the construction of the buyer’s project. And if the builder fails to deliver the project on time, they will be liable to refund the money with penal interest.

Gone are the days when builders withheld important information from buyers ( a major pain point for all buyers, especially NRIs) or deviated from the project by compromising on essential amenities and space.

The Act makes it mandatory for builders to furnish all relevant information about their project on their website, as well as on the RERA website – such as:

Moreover, once a project is approved, builders will not be allowed to make any changes without the written consent of at least two-thirds of the allotters.

This will prevent errant builders from withholding any important information from you. In other words, RERA gives you a full heads-up on your project via the Internet – without your having to run after your builder.

Tips On Bricks Episode 11 – “Definition of Carpet Area Under RERA”

In the post-RERA scenario, builders must mention the carpet area and balcony area clearly on the brochure and the website. This will help buyers to compare units available in the market easily and take the right decision.

In the pre-RERA days, it was common for unscrupulous builders to divert buyers’ investments to fund other projects. As a result, projects got delayed by years – and builders managed to get away under one pretext or another without having to pay any (or very little) interest to the buyer.

In the post-RERA scenario, buyers have two options:

In the post-RERA scenario, your builder will now have to regularly keep you and RERA updated with your project’s status.

A Golden Opportunity for NRIs to Invest in Property Post-RERA

False promises, lack of transparency or due diligence, and delays with little or no legal recourse for buyers are now a thing of the past. A strong regulatory body (RERA) is now in place to protect your property investment in every state and union territory of India.

For NRIs, the investment sentiment has received a major boost via RERA (as well as other government interventions like demonetization). With interest rates on home loans already coming down, it’s the right time to buy your dream NRI retirement home – both from a living and investment standpoint.

Ashiana, Ashiana Housing build homes. Homes surrounded by vast green spaces and fresh breeze. Homes cocooned in secured gated complexes. Homes where futures are forged and there are opportunities to grow. And Homes in environments brimming with healthy activity, trust and respect. At heart, we build communities with care.

Other posts by Ashiana

Join 1000+ of fellow readers. Get expert real estate knowledge straight to your inbox absolutely free. Just enter your email address below.