| F | Maturity amount |

| P | Annual deposit amount |

| i | Interest rate |

| n | Number of years |

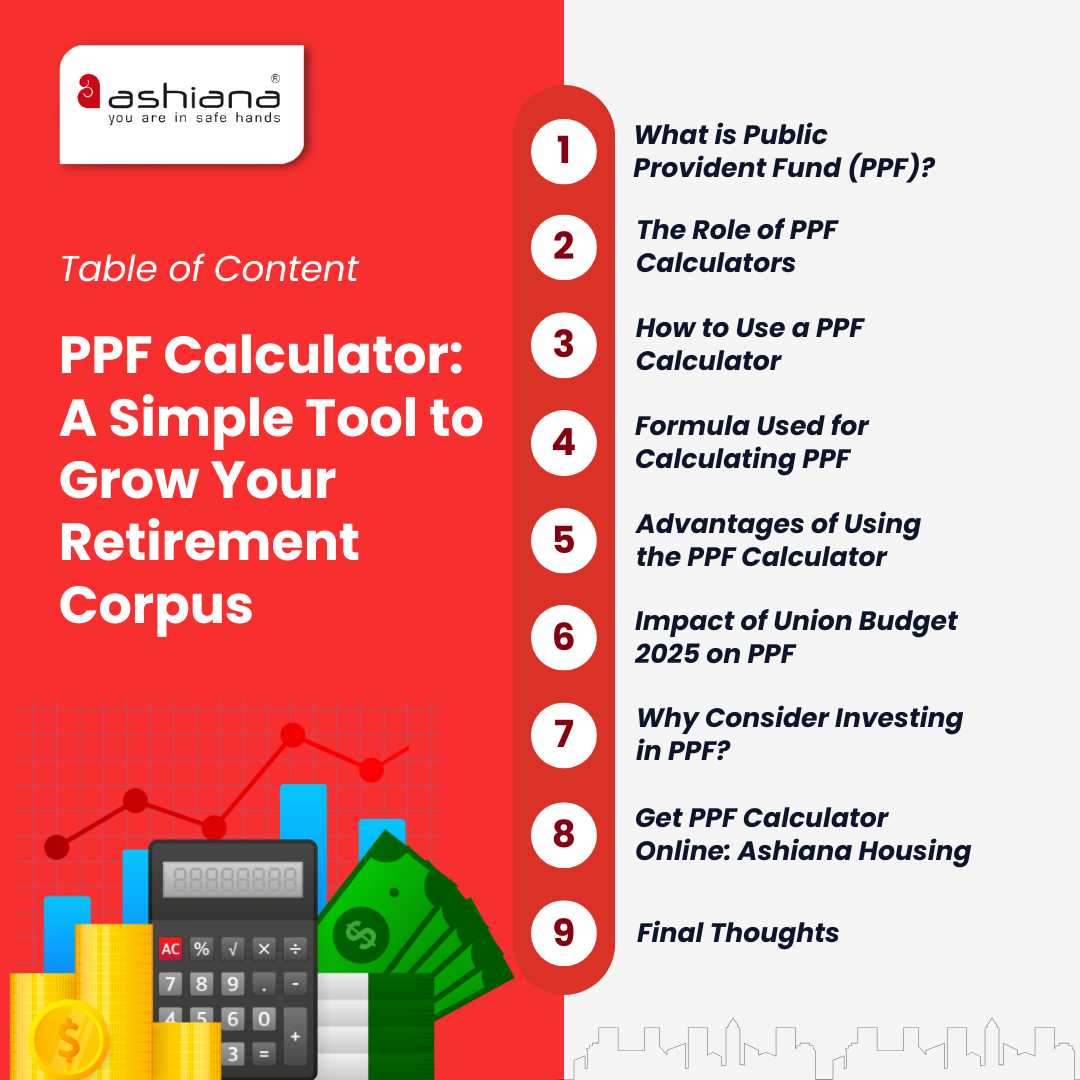

A PPF Calculator is an online tool that helps you estimate the maturity amount and interest earned on your Public Provident Fund (PPF) investment. By entering details like the annual deposit, tenure, and existing balance (if any), the calculator provides accurate results for better financial planning.

Yes, a PPF Calculator with an existing balance feature allows you to include your current PPF account balance. This ensures a more precise estimate of your total returns and maturity amount.

You can find a user-friendly PPF Calculator on Ashiana Housing’s website. It offers an easy interface to compute returns and explore the benefits of PPF investments seamlessly.

Ashiana, Ashiana Housing build homes. Homes surrounded by vast green spaces and fresh breeze. Homes cocooned in secured gated complexes. Homes where futures are forged and there are opportunities to grow. And Homes in environments brimming with healthy activity, trust and respect. At heart, we build communities with care.

Other posts by Ashiana

Join 1000+ of fellow readers. Get expert real estate knowledge straight to your inbox absolutely free. Just enter your email address below.